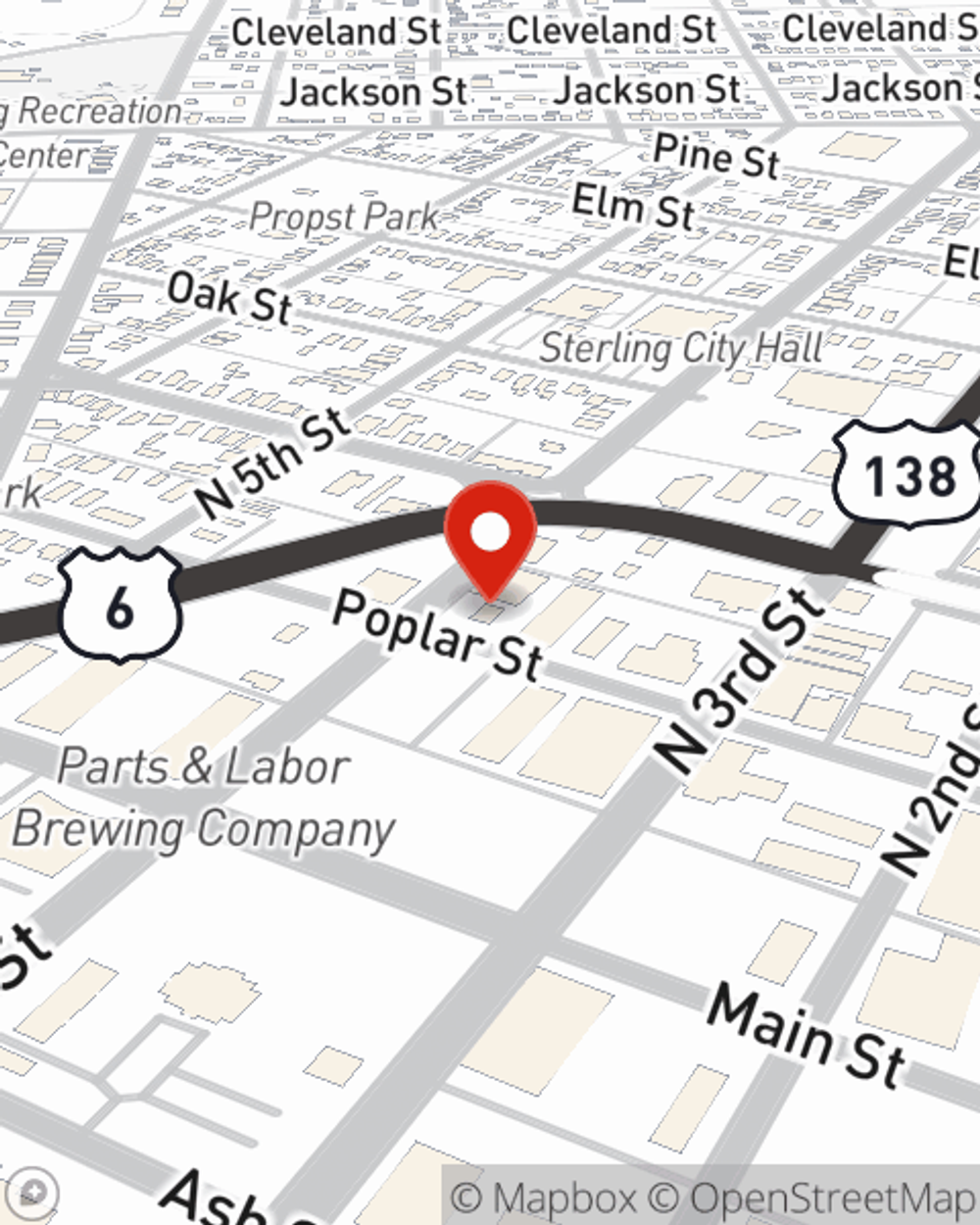

Business Insurance in and around Sterling

Looking for small business insurance coverage?

This small business insurance is not risky

Help Prepare Your Business For The Unexpected.

Small business owners like you have a lot on your plate. From marketing guru to product developer, you do as much as possible each day to make your business a success. Are you a physician, an optometrist or a piano tuner? Do you own a pizza parlor, a craft store or a dance school? Whatever you do, State Farm may have small business insurance to cover it.

Looking for small business insurance coverage?

This small business insurance is not risky

Protect Your Future With State Farm

You are dedicated to your small business like State Farm is dedicated to dependable insurance. That's why it only makes sense to check out their coverage offerings for builders risk insurance, worker’s compensation or commercial auto.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Randy Carruthers is here to help you discover your options. Call or email today!

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Randy Carruthers

State Farm® Insurance AgentSimple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.